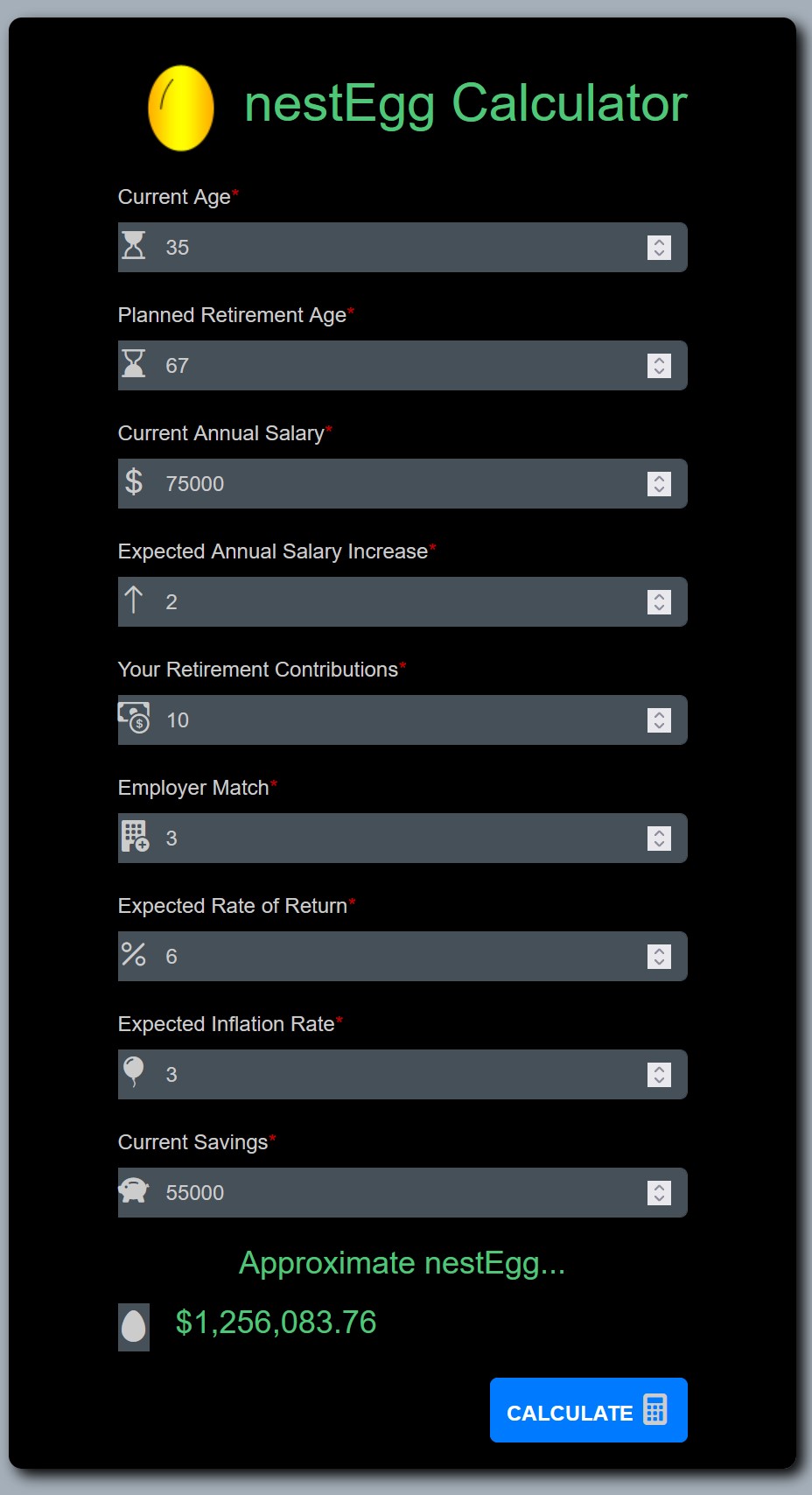

JavaScript based web form that can be used to calculate the future value of your retirement account AKA your nest egg.

The nestEgg Calculator is a simple and easy-to-use calculator that allows users to estimate the future value of their retirement fund. The calculator takes into account various user inputs, such as current age, planned retirement age, current annual salary, expected annual salary increase, retirement contributions, employer match, expected rate of return, expected inflation rate, and current savings.

Calculates the future value of the user's retirement fund based on various inputs

Provides a breakdown of the user's retirement contributions and employer match

Allows users to save their inputs for future reference

To use the nestEgg Calculator, simply download the files and open the index.html file in your web browser.

The NestEgg Calculator requires the following inputs:

Current Age: The user's current age.

Planned Retirement Age: The age at which the user plans to retire.

Current Annual Salary: The user's current annual salary.

Expected Annual Salary Increase: The expected annual increase in the user's salary.

Retirement Contributions: The percentage of the user's salary that they contribute to their retirement fund.

Employer Match: The percentage of the user's salary that their employer contributes to their retirement fund.

Expected Rate of Return: The expected annual rate of return on the user's retirement fund.

Expected Inflation Rate: The expected annual inflation rate.

Current Savings: The user's current retirement savings.

Enter the required inputs in the designated fields.

Click the "Calculate" button to see the estimated future value of your retirement fund.

Review the breakdown of your retirement contributions and employer match.

Save your inputs for future reference by clicking the "Save" button.